How to Do a Life Audit Through the Wealth Ecosystem Framework

When most people hear the word “wealth,” their minds immediately go to money. Numbers in a bank account. Income. Investments.

But here’s the truth I’ve learned: wealth is not just financial. True wealth is an ecosystem, a set of interconnected areas in your life that all work together to sustain your well-being, your energy, and your ability to grow.

If even one area of that ecosystem is neglected, your financial life will eventually reflect the imbalance.

That’s why I created what I call the Wealth Ecosystem Framework, a holistic way to look at your life and money beyond the numbers. Today, I’m going to guide you through how to do your own life audit using this framework so you can see where you’re thriving, where you’re neglecting yourself, and what adjustments could directly impact your wealth-building journey.

Step 1: Create Your Wealth Ecosystem Chart

Grab a piece of paper and something to write with. You can draw this in different ways:

A large circle divided into 7 slices

A grid of 7 squares

A simple list with 7 categories

Choose whichever feels good to you. Sometimes it’s fun to make it visual with a circle or wheel, but even a list works.

Once you have your chart ready, label each section with these 7 Wealth Ecosystem categories:

Health

Relationships

Time & Energy

Education & Financial Literacy

Career & Work Opportunities

Environment

Identity, Purpose & Spiritual Alignment

You can also add an 8th category, Finances, if you want to reflect directly on your money, although the original point of this exercise is to look beyond the numbers.

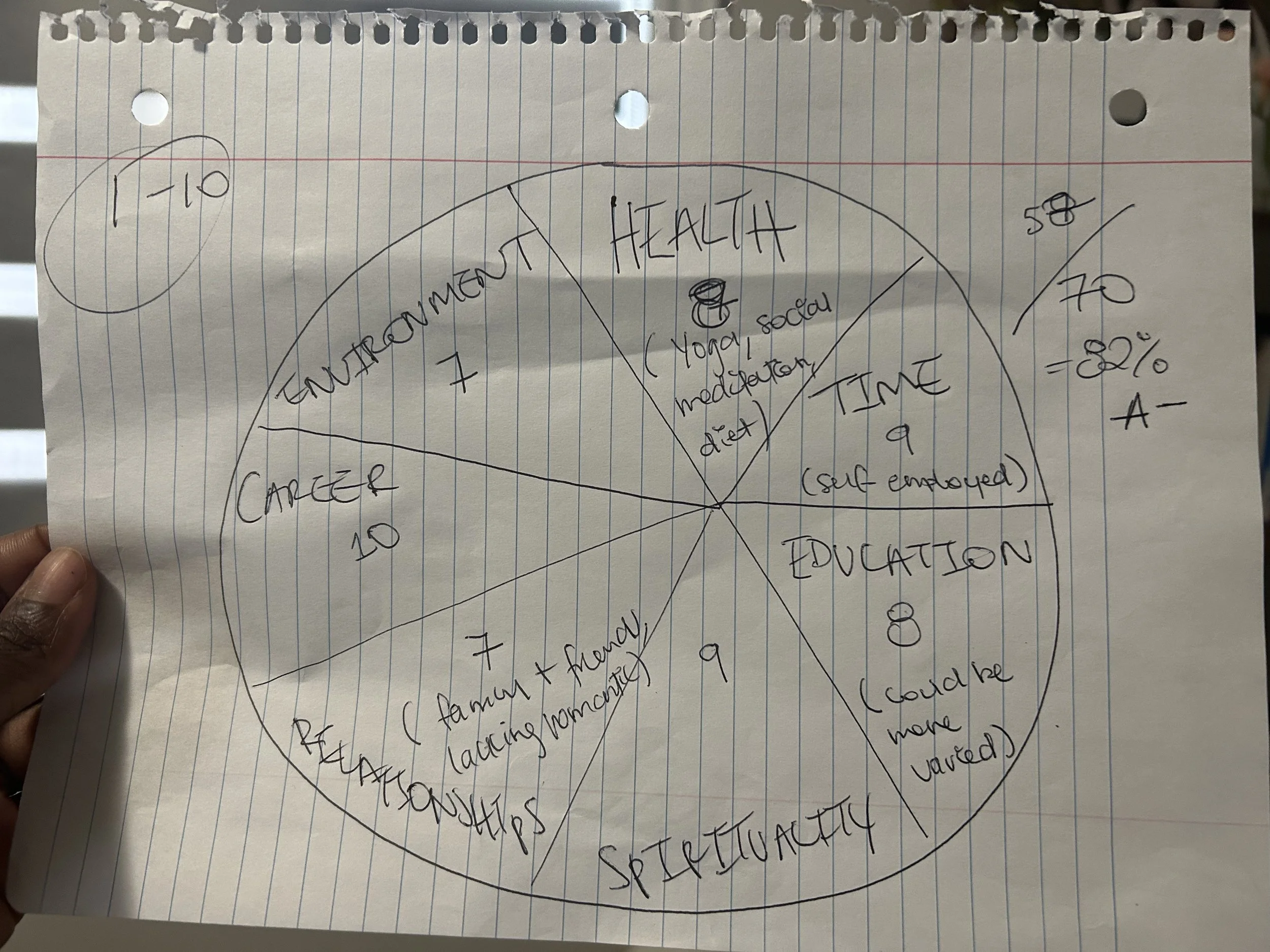

*my very scrappy wealth ecosystem audit

Step 2: Define the 7 Pillars of Your Wealth Ecosystem

Let’s briefly go through each of these categories so you know how to evaluate them in your own life.

1. Health

This includes your mental, emotional, physical, and spiritual health. Health is often the most layered category because you might feel strong in one area but lacking in another. For example, you may feel mentally sharp but physically depleted, or emotionally balanced but spiritually disconnected.

The saying “health is wealth” exists for a reason. Without a strong baseline of health, it’s hard to summon the energy and clarity needed to build wealth.

2. Relationships

This category includes romantic, family, friendships, colleagues, and social circles. The people around you shape how you view money, how you manage it, and even your beliefs about what’s possible.

Ask yourself: are my relationships supportive, loving, and empowering? Or are they draining, chaotic, or full of unhealthy patterns?

3. Time & Energy

You cannot buy back time. And if your days are stretched thin or your energy is constantly depleted, you won’t have the capacity to make or manage money in sustainable ways.

This pillar is about time management, energy levels, and balance. Do you feel spaciousness in your life? Or do you feel like you’re constantly running on empty?

4. Education & Financial Literacy

Wealth building isn’t just about what you earn, it’s about what you know and what you do with it.

Ask yourself: am I learning about financial literacy, money systems, and how wealth works? Do I understand credit, debt, investing, assets versus liabilities? Do I seek out new knowledge that can help me build, sustain, and grow my wealth?

When you know better, you do better.

5. Career & Work Opportunities

This is about the alignment, fulfillment, and opportunities in your work. Do you feel inspired and resourced in your current career? Do you have access to opportunities? Or are you struggling with barriers such as discrimination, lack of access, or a job that drains you without fueling your long-term goals?

Career equity is about both what you do and the systemic realities that impact your options.

6. Environment

Your environment shapes your energy. This includes both your physical space (your home, neighborhood, living conditions) and your ecological impact (how you engage with the planet).

Ask yourself: does my environment feel safe, nurturing, and supportive? Or does it feel toxic, unstable, or draining?

7. Identity, Purpose & Spiritual Alignment

Wealth is harder to hold if you’re out of alignment with your purpose.

This pillar is about your sense of self, values, and connection to something greater. Are you doing work that fulfills you? Do you feel clear about why you’re here? Do your financial decisions align with your deeper values and integrity?

When you feel disconnected from your purpose, it often shows up in money decisions that don’t feel good long-term.

Step 3: Rank Yourself

For each of the 7 categories, rate yourself on a scale of 1 to 10:

1 = completely unfulfilled

10 = thriving and fulfilled

Be honest. This is not about judgment or shame. It’s simply data, a snapshot of where you are right now.

For example, when I did my own audit recently, my scores looked like this:

Health: 8

Time: 9

Education: 8

Spirituality: 9

Relationships: 7

Career: 10

Environment: 7

Finances (added as an extra slice): 5

When I tallied it up, I scored 58 out of 70, which is about an A- grade.

Step 4: Reflect on the Results

Once you’ve rated yourself, pause and reflect. Ask yourself:

What’s thriving? Which areas are 7 or above? Celebrate what’s going well.

What’s neglected? Which areas are under 7? Where are you leaking energy or neglecting yourself?

What’s required? What actions, boundaries, or shifts would improve the neglected areas?

What’s connected to money? Which categories directly impact your ability to earn, manage, or grow wealth?

For me, the categories where I scored lower, such as environment, relationships, and finances, were directly affecting my money. My nomadic lifestyle was impacting stability. My relationships were fulfilling but lacked a long-term partner. And financially, I was still bouncing back after inconsistent business income.

Why the Wealth Ecosystem Matters

When you look at your life this way, you start to realize something powerful:

👉 Wealth is not just money.

You could have six figures in your bank account and still feel empty, anxious, or burnt out. On the other hand, you could be in a rebuilding phase financially but feel deeply fulfilled, supported, and aligned in every other area of your life.

The Wealth Ecosystem Framework helps you see the full picture so you can build wealth that feels good and sustains you.

Make the Wealth Audit a Regular Practice

Your Wealth Ecosystem will change with time. Some seasons you’ll score higher. Others you’ll score lower. That’s normal.

The key is to treat this as a regular practice. Check in every few months, or at least once a year. Compare your new results with past audits. Notice where you’ve grown, where you’ve regressed, and what patterns keep repeating.

There’s no shame if your scores dip. Life happens. The point is to notice, reflect, and adjust.

Wealth is not just a paycheck, a budget, or an investment portfolio. Wealth is how you feel, how you live, and how supported you are in all areas of your life. When you nurture your health, relationships, time, education, career, environment, and purpose, you create a foundation where financial wealth can actually grow and last.

So try this: complete your own Wealth Ecosystem Audit this week. See what comes up. Notice where you’re thriving and where you can show yourself more love and attention.

And remember, this is not about perfection. It’s about progress, reflection, and building a life that feels abundant from the inside out.

〰️ LISTEN TO THE PODCAST OR WATCH THE VIDEO

↳ Listen to the full podcast version

↳ Watch the YouTube Video

〰️ WORK WITH ME

↳ my coaching services https://bit.ly/3ZAs0NZ

↴ additional resources and perks:

→ Watch my FREE Webinar 'From Financial Confusion to Clarity' - https://bit.ly/4h7dXqq 📺

→ Download my free ebook on mastering your money mindset https://bit.ly/3fAfj33 💵

→ Download my free Wealth Tracker - https://bit.ly/48H8Rxj 🧮

→ Invest in stocks with Wealthsimple https://bit.ly/3PJYscp 📈

→ Invest in crypto and receive $25 USD https://bit.ly/3TxD4dr 🪙

→ Invest like the rich in art and receive a $200 bonus (USD only) https://bit.ly/3Popuqh 🖼️

→ Sign up for my bi-weekly newsletters https://bit.ly/466g09H 📨

〰️ CONTACT ME

✉️ hello@morganblackman.com